BaaS and BaaP – Financial technology, is an industry that combines and groups companies that are making financial services great again. This wave is also making insurance services more efficient and advanced. With the use of technology in financial services on top of blockchain, machine learning, big data, and data science, FinTech businesses are becoming the first choice for every startup. Even big brothers like Facebook, Apple, and Google can’t escape this temptation.

FinTech in Indian Market

Between 2014 and 2016 till date, the Indian market has seen hundreds of thousands of companies claiming to be FinTech, and if you check the profiles of people, every third person as of date is an expert and doing payments or variations of payment services. Please read the disclaimer for more details about my posts, subjects, and relevance.

FinTech, or Financial technology, is an industry that combines and groups companies that are making financial services, including insurance services, more efficient and advanced.

For FinTech, it’s an opportunity to pick services to push through the BaaP and BaaS models, and owning an entire business paradigm is neither feasible nor desirable anymore. Almost all players who entered payments and insurance in the FinTech domain are actually coming out of this game with zero or no knowledge. This is too much innovation to put the idea on the table, but it takes longer to make it a reality.

Technical companies are entering the financial domain and making it interesting by doing technical integration, or “fintegration”, of FinTech services, the latter interfacing directly with bank customers for banking services including insurance.

FinTech Evolution

- FinTech 1.0 (1865 – 1966) – Finance and technology came together to produce the first analogue financial technologies such as the first transatlantic telegraphic cable.

- FinTech 2.0 (1967–2008): This era saw the digitalization and globalization of almost all traditional financial services and institutions, i.e., banks.

- FinTech 3.0 and FinTech 3.5 (2008–Now) The global financial crisis of 2008 challenged the dominance of traditional financial institutions and brought technology-driven start-ups into Finance, Investments, Risk management, digital payments, and data security.

- Companies coming into the FinTech domain are startups founded with the purpose of disrupting incumbent financial systems and corporations that rely less on software but more on Banking as a platform (Baap) and Banking as a service (BaaS).

Who are the leaders of FinTech

Most of the innovations in financial services, including insurance, are coming from leaders who are very new to the industry or come from outside the industry. SaaS (Software as a Service), IaaS (Infrastructure as a Service), and PaaS (Platform as a Service) might give birth to industry-specific services and platforms in the future, such as BaaS and BaaP (Banking as a Platform).

The correlation between income and access to formal financial services is still very strong; however, this landscape is now changing with incumbents and mobile/internet innovators now integrating with the mainstream banking system and supported by relaxed regulatory frameworks, i.e., self-regulation, up to an extent by FinTech service providers really pushing hard to change the world. Entrepreneurs are leading a pack of disrupters, most of them raised in the shadow of companies like PayPal, who want to change business relationships with money forever.

Banking as a Service

The days are not far away when one can get an independent license or permission to run banking services without being titled or registered as a bank. BaaS providers will provide limited services to ensure customer service at an optimum level, including round-the-clock access from wherever you are in a very safe and secure environment. So in a nutshell, I am claiming divorce of bank and banking (What is needed: Bank or Banking).

Actually, if my calculation and understanding are correct, then the payment bank phenomenon in India is actually a BaaS with the help of a BaaP at the backend. Hundreds of companies came up and want to come up. Few got licenses, but that does not discourage the rest of the companies from pursuing their dreams.

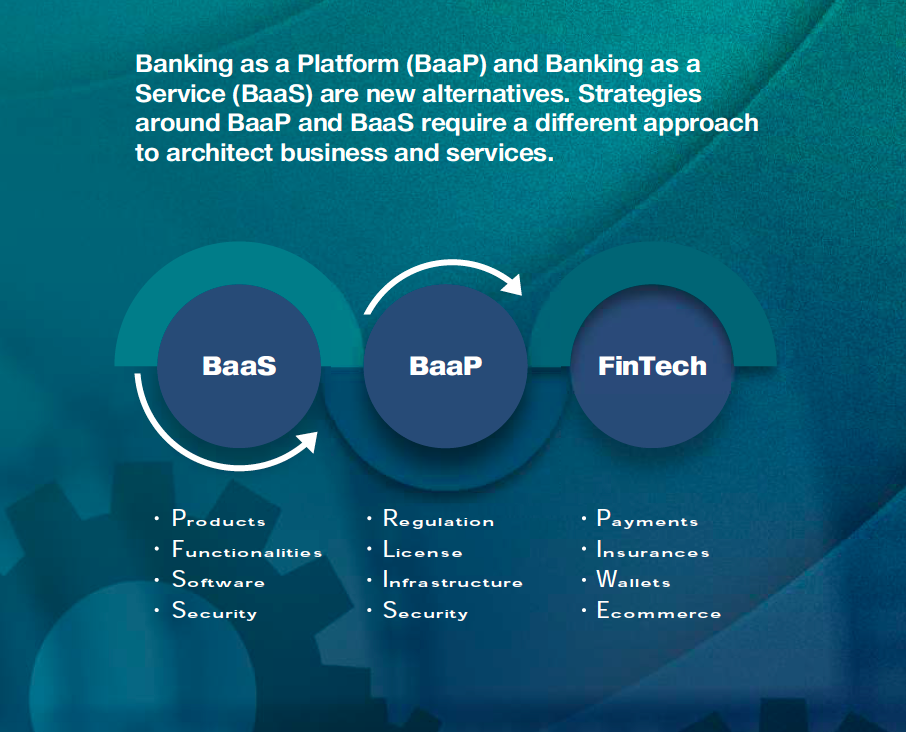

How does FinTech fit into or absorb BaaP and BaaS? Who is who, and what could be the relationship between FinTech and BaaP and BaaS? Well, in my eyes, (I would like to be

corrected) FinTech can sit on top, and BaaS and BaaP become types of FinTech companies, so either a company can be a BaaP FinTech company or a BaaS FinTech company, or depending upon funding and dreams, a single company can be both.

corrected) FinTech can sit on top, and BaaS and BaaP become types of FinTech companies, so either a company can be a BaaP FinTech company or a BaaS FinTech company, or depending upon funding and dreams, a single company can be both.

This domain was not opened and was not an interesting space to be in for a very long time. If I recall, the view was that there were such strong monopolies there in terms of the existing banks and insurance companies that no one built a successful payment or insurance company with the exception of 1 or 2 names that were too limited to very few advanced and developed markets. Micro-Payments and micro-insurance market sizes are almost as equal to the macro market in terms of value, but yes, volume is almost 2 to 3 folds higher

BaaS FinTech

Banking (Services) and insurance, as FinTech, have existed since early 2000 and got stronger and stronger with the rise of mobile money and mobile payment services. MNO was the first to pick up the opportunity and start giving banks a hard time. The idea of BaaS gained rocket speed in a market where banking penetration was almost nonexistent and banks were not interested in entering the market due to many reasons.

Integration (financial services integration) and delivery of fin-services are changing and coming out as services and platforms that can house new channels, products, partnerships, and opportunities. Banking as a Platform (BaaP) and Banking as a Service (BaaS) are new alternatives. Strategies around BaaP and BaaS require a different approach to architecting businesses and services.

It was taken for granted that Banking (a beautiful and useful phenomenon) and banking (long ago, a big building used to employ lots of people and consume too much space, money, power, and IT machines but used to work very slowly and for very limited times of the day and weeks) are very tightly coupled and married forever. MNOs and a few other companies (Later known as Mobile Financial Service Providers) saw the difference and jumped in between banking and banks, successfully getting them divorced or at least managing to find their relationship with banking.

BaaP FinTech

Banking as a Platform is not a new term; looking at it from this angle, it might be new. All platform providers for FinTech services came to life at the same time when BaaS came to life, as BaaS came from companies other than Banks. The banking services served by FinTech leaders are very innovative, different, and easy to use and make use of to benefit businesses.

Fintech, as the leader of today’s global financial services, knows that modern payment solutions need to be able to evolve and adapt, nimbly and securely, to the ever-changing trends in consumer behavior. By the way, BaaP-Fintech built infrastructure to enable more merchants to accept payments. Hosting banking services or giving banking services to end users is becoming easier. There was an article I wrote on the same line on June 16, 2015, “Cloud-based Mobile Financial Services and Payments.“

Analysing – BaaP and BaaS

BaaP-FinTech will actually support all small-scale FinTech companies to come together. With the help of BaaS on BaaP, new innovative services to consumers will bring lots of value, and new products will be available in a kind of pool where hosting will make it easier to use any service by any consumer of any service provider. Adding the flavor of Finclusion on top of BaaS will really help exit services reach segments that are excluded.

In the IT domain, we have three “aas” services broadly classified as Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS), and all of them are quite useful for the FinTech domain, but time is here to extract the best out of all “?aas” services to bring BaaP and BaaS. Both Baas and BaaP will be a driven version, specialized and designed for financial services, including insurance for payments, Finclusion (financial inclusion), and insurance. Defining any of IaaS, PaaS, or SaaS or talking about their advantages and disadvantages is out of scope here as the focus is on BaaP and BaaS.

Challenges and Complexities of BaaP-FinTech

BaaP-FinTech is not an easy route or option, as to me it’s still a dream, and to many others, BaaP is already facing difficulties to come to life and protests from service providers as well as platform providers. The service provider argument is that I am the biggest, I am the boss, or I am the king; I own the customer; why should I share anything? A platform provider sees value in selling more platforms to many service providers, selling ideas from one service provider to other service providers and vice versa, developing one functionality once and selling it multiple times to many, and making huge money out of it.

Missing out on all the small players who have excellent ideas and can make wonderful products that can be very valuable and beneficial to end consumers. Resistance BaaP faces and will always face, as the traditional model is far easier. Banks and insurers are at large risk of losing their dominant position in the African market; to some extent, they’ve already lost it.

The reality and status of the current availability of services from banks are far behind the capabilities of modern infrastructure and new e-commerce innovations. The financial sector is already facing significant competition in the electronic and online spaces. Today, people still keep their money in the banks because it’s the institution created for money (for ages). Basically, what money and the economy mean for people, as we know, is trust.

BaaS and BaaP: Paving the Way for Digital Banking Revolution

However, it was the wallet in the pocket that became the prime target, creating complications in integrating various funding sources such as bank accounts, mobile wallets, and plastic cards. Amidst this, BaaS and BaaP emerge as pivotal players with the potential for resounding success. Banks and insurers, traditionally central to customer engagement, are set to transition into a future where a fully licensed digital bank, empowered by BaaS and BaaP, will drive an expansive spectrum of FinTech services.

Moreover, all reports and real facts on the ground have shown that cross-border remittances contribute to high economic growth. AILabPage’s research indicates that it can have a greater impact than ODA and FDI as well. This might suggest that remittances serve as a social safety net for those who are not the poorest but who would be in need of targeted social assistance without remittances.

Do we really need this new BaaP or BaaS; I think it’s very easy to answer or has the answer already “Yes”. How long has it been staying the same?.Books + Other readings Referred

- Research through Open Internet – NewsPortals, Economic development report papers and conferences.

- Personal experience of @AILabPage members.

Conclusion: The financial services industry, including the insurance industry, is facing a long-pending wave of digital disruption. This disruption has started to reshape the entire banking and payments sector. Payment as a Service (PYaaS)-type services are really needed in the industry. By looking at current issues like high cost, slow speed, and bundles of papers for KYC, this new concept of BaaS will revolutionize the market. We have too many payment companies in the market with zero or no experience but still doing well on a gratitude basis, as talent and education may not be needed here. Banks have platforms, but it’s probably fair to say it’s more like yesterday’s platform or the stone age.

Conclusion: The financial services industry, including the insurance industry, is facing a long-pending wave of digital disruption. This disruption has started to reshape the entire banking and payments sector. Payment as a Service (PYaaS)-type services are really needed in the industry. By looking at current issues like high cost, slow speed, and bundles of papers for KYC, this new concept of BaaS will revolutionize the market. We have too many payment companies in the market with zero or no experience but still doing well on a gratitude basis, as talent and education may not be needed here. Banks have platforms, but it’s probably fair to say it’s more like yesterday’s platform or the stone age.

Excellent resource thank you for sharing

[…] Little History on Financial Technology – FinTech […]

[…] https://vinodsblog.com/2016/03/25/fintech-the-baap-baas-boomer/ […]

[…] 2024, the FinTech sector faces challenges like reduced funding and increased regulatory scrutiny on Banking as a Service (BaaS) providers i.e. […]