Digital Payments – In the last few years, we have seen a tsunami-like disruption in payment services, which has caused eCommerce, wallet services, digital payments, and remittances to just explode. Artificial intelligence, with its subsets like machine learning, deep learning, and artificial neural networks, has made this industry almost an explosion point. Artificial Intelligence and any discussion around how this has gotten so much deeper in Fintech and what benefits it has provided will, unfortunately, remain out of scope for this post, and we will discuss AI and its merger with FinTech in other posts later this year. I wish you all a very happy New Year 2017. I am writing this post from La Reunion. Payments look easy, which is why innovation is so hard.

Introduction

Technology is changing at a rapid pace and with it, the consumer experience of buying goods and services. In the coming months, digital payments come to life in India as you board a bus in Bangalore city or a metro in Kochi city. That would accept cashless payments as India’s first smart cards. The card offers integrated services to commuters by offering them cashless bus and train travel. Additionally, it can be used in 1.8 million outlets across the country.

- Next-Generation Offer:

- Innovation, advancements, cleverness, coolness, and smartness are key characteristics of the next-generation offer.

- It caters to self-confident, quick, competent, global, tech-savvy, and demanding consumers.

- Communication Expectations:

- Consumers seek instant responses and resolutions via platforms like FB, Twitter, Skype, or WhatsApp, emphasizing the need for seamless and prompt customer service.

- Investor Interest:

- Investors, through private equity or crowd investing, desire simplified access to platforms that provide visibility and investment opportunities for newly founded companies or projects.

- Instant Payments Landscape:

- The landscape of instant payments is expanding, with banks, FinTech, and merchants recognizing the advantages.

- Understanding both the value and challenges of real-time processing becomes crucial in this context.

- Mobile Wallets Challenges:

- Attracting a wide user base has been challenging for mobile wallets.

- Research data from Google in the USA reveals that, as of the end of 2016, older payment methods still dominate, with PayPal in-store leading at 18%, followed by Walmart Pay at 14%.

- Apple Pay, at 8%, slightly surpasses Android Pay and Samsung Pay

New markets, products and services are emerging so quickly it is difficult for consumers and regulators to keep pace. Consumers often have to figure out new technologies for themselves. Key success will be in by offering a full range of merchant solutions for ecommerce as well as retail and mobile order customers. Prides itself will be high-level security, customer support that will put merchants on the road to success.

To draw a rough sketch of an exaggerated scenario of how these two technologies (AI and FinTech) may interact with us in the future and what warrants the, perhaps perplexing, two super powers. AI’s control systems are widely used. They govern how a simple thermostat adapts to a target temperature.

Digital Payments – Basics

In the last few years, almost 5 years, we have seen a tsunami-like disruption in payment services, which led eCommerce, wallet services, digital payments, and remittances to just explode. If we review just the last 2 years of work and consider the impact of it on this year, it would give us a very clear projected picture. The year 2015 can be written down as a year of awareness and noticing payment methods other than cash.

In 2017, we will see (most likely as per my calculations and observations) consumers gearing up for technology, making themselves ready to pay a little extra for convenience, and winning comfort from their cozy rooms. Consumers will be willing to pay for convenience and fast delivery internationally for all global players. Banks have seen the greatest disruption so far in money transfers—sending money from person to person, either domestically or internationally. This year In, we will find the FinTech tsunami, which will offer affordable payment services. The product mix I will include includes e-commerce functionality, mail, mobile commerce, high-volume offline and online card processing, mobile payments, and retail commerce.

- In 2016, the financial services landscape witnessed significant technological innovations, leading to a wave of trials and adoptions, particularly in India.

- The year marked a transformative period for the Indian payment industry, triggered by a radical change on November 8, 2016. Despite challenges faced by consumers, the phase was considered extraordinary in Indian banking history.

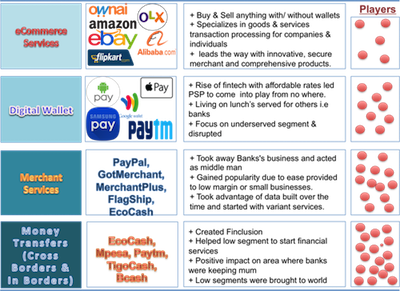

- The shift towards Banking as a Service (BaaS) over Banking as a Platform (BaaP) is anticipated to yield results. The evolving payment ecosystem, encompassing e-commerce, digital wallets, and money transfers, encourages a reimagining of relationships between banks, retailers, and Fintech, emphasizing collaboration for mutual benefit.

The change in this segment is so huge which cant be absorbed alone by one type of business entity. Payments gateway and solution service companies experimenting with customised solutions rather than giving one-size-fits-all (Like a master one master key for all holes) product solutions to merchants.

Communication in Digital Payments

Today’s generation of consumers has high expectations when it comes to transparency and flexibility. Modern asset managers act quickly, effectively and transparently. They facilitate an independent yet customised solution and serve as clients’ professional link to all new technologies.

Payment systems are pivotal in any economy given their role to facilitate the intermediation process, which is key to achieve financial stability. Payments are a daily and routine activity carried out by people in most parts of the world. These payments cover daily human requirements from transportation, food and communication. Some people transact 2-5 times in a day while some more than 20 times making them heavy users of payment systems.

Nearly two-thirds of U.S. cardholders are familiar with at least one form of mobile payment, marking an awareness trend that continues to rise and could ultimately translate to higher adoption and usage rates. But does awareness translates to usage? It might — 74% of consumers who have not used any of the major mobile payment apps say they are interested in doing so in the future, according to new research.

Need of Speed

Year 2017 will the year of instant digital payment which does instantaneous validation, acknowledgement, and transmission of transaction data between the point of sale and merchants system as oppose to year 2016 which was “near real time,” which refers to expedited batches that may range from minutes apart to an hour or even more, real time is truly instantaneous processing. Today’s consumers are quickly coming to expect immediate processing of their payments.

- Technological Constraints in M-Commerce:

- Mobile devices’ limitations, such as screen size and processing power, can affect the information provided during m-commerce transactions and raise security concerns.

- Identifying constant principles despite technological change is crucial to help consumers engage confidently with a changing market and assist regulators in addressing emerging failures.

- Mobile Money and Financial Inclusion:

- Over a billion people in emerging markets use cellphones for financial transactions due to the lack of bank accounts, and mobile money services are filling this gap by offering various financial services.

- This has the potential to reduce transaction costs and mitigate the risks associated with informal networks, contributing to financial inclusion.

- Impact of Digital Technology on M-Commerce:

- Digital technology has significantly expanded the scope of m-commerce, allowing consumers to perform various transactions using their mobile devices and offering new opportunities for businesses.

Even in markets yet to move to real-time payments, such as the US, banks are trying to recapture their position in money transfers. Recent examples of activity include Early Warning acquiring clearXchange, BBVA partnering with Dwolla, and TD Bank exploring opportunities with Ripple.

Conclusion – Country like South Africa, which has, if not highest in the world but many services where Cash is not allowed to come in as those are strictly “No-Cash” services. An innovative leap is currently taking place under the keywords of social media and FinTech. Many banking services are being redefined. This includes technologies related to e-commerce, mobile payments, crowdlending, crowdinvesting and asset management. The result will be a future in which many services are only offered electronically. Countless finance apps exist which generate added value for clients. These can be used to query master data, receive business news, create portfolios, enter payments, draw up charts, convert currencies, etc. These key challenges that banks and merchants need to know and have solutions ready when embarking on real-time payment processing.

====================== About the Author =================================

Read about Author at : About Me

Thank you all, for spending your time reading this post. Please share your feedback / comments / critics / agreements or disagreement. Remark for more details about posts, subjects and relevance please read the disclaimer.

FacebookPage Twitter ContactMe LinkedinPage ==========================================================================

Excellent Post. I agree 2017 will be exciting but bit low for fintech

Reblogged this on sheetal05.

Good one with the better understanding of market.

Getting to understand this Cashless payment better was used to move around with hard Cash ,thank you for the post

[…] Mr. President said, “I urge all parties to participate in Fintech, IT and financial technology. I will continue to discuss and allow for breakthroughs for digital applications, so as to increase our financial inclusion. Let us together build synergy,” during his speech at the Indonesia Fintech Festival & Conference in same week. For more details on Digital Money and its wonders read 2017 Year of Digital Payments […]

[…] Mr. President said, “I urge all parties to participate in Fintech, IT and financial technology. I will continue to discuss and allow for breakthroughs for digital applications, so as to increase our financial inclusion. Let us together build synergy,” during his speech at the Indonesia Fintech Festival & Conference in same week. For more details on Digital Money and its wonders read 2017 Year of Digital Payments […]

[…] Mr. President said, “I urge all parties to participate in Fintech, IT and financial technology. I will continue to discuss and allow for breakthroughs for digital applications, so as to increase our financial inclusion. Let us together build synergy,” during his speech at the Indonesia Fintech Festival & Conference in same week. For more details on Digital Money and its wonders read 2017 Year of Digital Payments […]

Slowly the cashless future is revealing itself. Good read

[…] is part 3 of my CashLess/LessCash subject serious part-1 : CashLess-OR-LessCash and part-2 : 2017 Year of Digital Payments has starting strings on same subject and its good to start from part-1 and then to part-2 and […]

[…] via 2017 Year of Digital Payments — Vinod Sharma’s Blog […]

It helped me to understand the future of digital payments. Thank you very much Vinod Sir..

Good one indeed.

[…] Story – In my first post of this year 2017 Year of Digital Payments, I mentioned about digital payments and needs now in here I am trying to be specific about how much […]

The Internet has evolved into a conduit for financial system-related technology developments, including payment systems. The dynamic payments sector is known for its innovation and speed.