AI Bond With FinTech – FinTech or Financial technology is an industry combining and grouping companies that are making financial services (including insurance) more efficient and advanced; with the use of technology. We are in FinTech 3.5 or FinTech 4.0 era as the global financial crisis of 2008 challenged the dominance of traditional financial institutions. This brought technology-driven start-ups Finance, Investments, Risk management, digital payments and data security.

Past & Present of Financial Services

Financial payments and banking started in a very inefficient and traditional way, which was slow but still acceptable to the customers due to the stage in the information age. FinTech is now changing the whole game.

In my personal opinion and hand on experience FinTech was, is and will remain Blue Ocean player where its all about collaboration, partnership and synergies. Competition is a red ocean game. So I say FinTech is the Blue Ocean Strategy player. With this strategy in mind of FinTech; AI is now reinventing it and its now FinTech Intelligence.

There are lucrative but under-utilised banking opportunities. Banks in the region need to step up and grasp these opportunities to succeed otherwise its almost a lost game for them. AI technologies such as machine learning, deep learning, prescriptive learning, predictive analytics, virtual agents and natural language understanding technologies are gaining popularity among progressive banks.

AI in FinTech

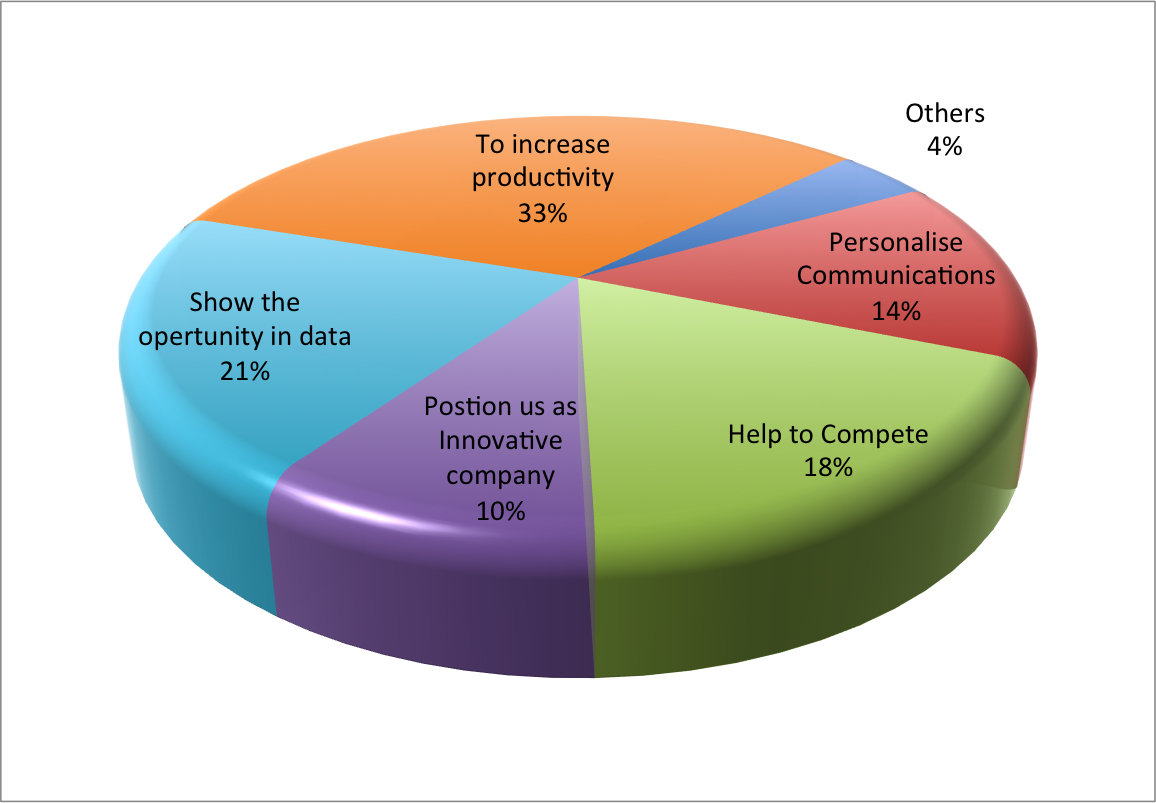

AI is not a magic push button and it will never be. It works as a strategy if one adopts it will take them to a new height. For financial institutions, FinTechs and banks; data and security play a critical role. Competition in the Fintech world today at its peak, so the adoption of new technologies to stay one step ahead of the competition is no brainier.

AI in Fintech allows eliminating human error while boosting productivity and increasing the bottom line. With advancement in technology, organisations outside the banking industry diversified into financial services targeting margins in the space.

These were organisations servicing millions of customers through broad distribution channels, be they mobile operators, retailers or online merchants. Artificial Intelligence offering numerous opportunities to payments and to almost every other industry of today. It’s a simple rule to adapt or be adapted and become part of history books. Financial or banking is getting hit hard the most. AI reinventing and increasing info-security, reducing processing times, reducing duplicate expenses and human errors to make it more viable in the filed of FinTech.

Banks and Banking are no longer a married couple

Banks to set them on for new financial, banking and innovative business. What would have been considered impossible until a few years ago — transforming themselves from impassable monoliths to nimbler organisations, open to new kinds of partnerships? Now increasing levels of automation, offering game-changing insights with data mining and balancing consumer budgets based on spending patterns are the latest powerful tools for any FinTech or bank of today.

Banking-as-a-Service (BaaS) would become more acceptable and popular compared to Banking-as-a-Platform (BaaP) as BaaS aptly describes the new strategy of providing public APIs and development portals. It would very exciting to see how and what role AI will play in Fintech in the near future. Chatbots in financial services are not new though but chatbots are now getting much smarter with help of AI and NLP.

One-liners

Some of the one-liners I always use for AI buzz words as these buzz words are around us almost everywhere and we often hear them in and out.

- Machine Learning – Never need your brain to program anything

- Deep Learning – is really deep not the just namesake

- ANI – Narrow AI example Siri, Cortana and Google Assistant.

- Bots – Not a boat, Not a Messenger, Not a Robot and not necessary an AI child

- ASI – Super intelligence much higher than the human mind or capability. May fall in love with your girlfriend or wife be-careful.

- Big Data –This data is really big and requires proper tool, seriousness and attention

- Natural Language Processing (NLP) – Yes it’s really natural up to an extent

- Artificial Intelligence (AI) – Attempt of human brain parody

- Data Science is not just BigData, may be an ocean which holds this small big data.

- AGI – at the level of human failed capacity i.e Self-driving cars

How AI is reinventing FinTech

AI is now bringing behavioural biometrics to a business tool for real. Static biometrics such as vein pattern, fingerprint, retina scan, selfie, are all nearly unchangeable but still not impossible. Deep neural networks (DNN) are being used to bring dynamic changes. Behavioural biometrics presents a fairly new approach to monitor and score customer and device interactions during transactions. Behavioural Biometrics: Dynamic Approach to Authentication and Security.

Behavioural biometrics solutions are able to create a more precise picture of the user by examining a range of behavioural pattern. BB is deductive, full of reasoning, and has extreme potential for problem-solving abilities with AI for FinTech. Artificial Intelligence coming down from its 50,000 feet high hype to ground reality for the actual business benefits and everyday life. AI is no longer a study material for PHD.

AI is now helping and supporting predictive analytics problem in a quick manner to conduct specific observations to make broad general statements. It is now playing a master key role in creating personalized user experiences. Learning from customer preference history, browsing app history, notifying the customer of similar products and services. Use AI to help break the tradition of using data to report historical trends and to justify reactionary decisions. Cultivate a proactive approach, which benefits both the business and the customers.

AI in Fintech is a great help & ease for understanding on how the automation can be achieved for automated tasks (yes it’s true). Machine Learning focuses on predictions, based on known properties learned from the training data using too much statistical inductive reasoning. It’s been said ML works very well as long as the past gets repeated in future. Financial chatbots use predictive analytics to push out real-time, informed responses to customers without the need for human intervention.

AA

The expert system in FinTech with AI

Expert System is a computer system that emulates the decision-making ability of human expert using deductive reasoning. Big data helps to make a strategy for the future and understand user behaviour. Not just data but quality data – Focus on quality data rather quantity as data is the next most expensive commodity after fuel. Treat network traffic as a ‘gold mine’ – Data is yours, use every bit of It. Capture everything to avoid blind spots – Look at the full/big picture.

Underlying technology-using AI as it provides deeper insights to understand business. We need to be agile enough to know and accept the fact that every business of today operates in real time so not just BI we need Intelligent BI. Intelligent BI with predictive analytics is a masterstroke in any strategy formulation. AI is driving the ability to build knowledge at high speed, quicken decision making from Big Data. Data Analytics should have a purpose, be grounded in the right foundation, and always be conducted with adoption in mind.

Unfortunately, so far only intelligence got artificial but the risk still remains for real and natural. Natural language generation can create, write and tell your business stories but still raise hands when risk overtakes. I am getting tempted to say — this time is really different. AI DAOs – AI that can accumulate wealth, that you can’t turn off.

As a Service Architecture

Interoperability or “ As a Service” concept/economy or simply “Everything as a Service” now bringing these most advanced expensive and out of reach technologies to every small business to benefit from. AIaaS- AI as a Service – To bring small & start-up business close to industry standards – Help them to grow. MLaaS – Machine Learning as a Service is helping the payment industry big time, especially all those who are coming out of the payment industry to the payments industry.

How AI will be transforming the future of FinTech to elaborate items from the above list in African markets and opportunities are even more dramatic – In just the past five years. Modern mobile payment infrastructure availability – Africa has payment instruments such as mobile wallets for merchant payments, bill payments, prepaid airtime top-up etc.

Algorithms friends of AI now for FinTech

High-powered algorithms are not a new phenomenon in finance though, and for this industry, the name of the game is efficiency and precision which suites more for FinTech due to their fast adopting nature and risk appetite. Artificial intelligence may be all the craze in Silicon Valley, but on Wall Street, well, there’s a lot of scepticism.

Points to Note:

All credits if any remains on the original contributor only. We have covered all basics around myth on AI in FinTech, mobile payments, its models and the importance of quality services. In the next upcoming post will talk about implementation, usage and practice experience for markets.

Books + Other readings Referred

- Research through open internet, news portals, white papers and imparted knowledge via live conferences & lectures.

- Lab and hands-on experience of @AILabPage (Self-taught learners group) members.

Feedback & Further Question

Do you have any questions about AI, Machine Learning, Telecom billing/charging, Data Science or Big Data Analytics? Leave a question in a comment section or ask via email. Will try best to answer it.

Conclusion – Artificial intelligence is set to transform the financial services industry. It helps eCommerce business and companies for driving more seamless shopping experience for its customers and taking orders directly from social media channels. For banks and FinTech, it helps and supervises consumer credit scoring and at end inform consumers for an upcoming event like payments due and to create realistic budgets.

Smart machines producing smart payments with inbuilt payment intelligence. Please note I am not advocating AI on blockchain here as basic architecture for both as per my understanding is lot different as on date. Also Deep Learning is different from traditional predictive analytics in my opinion hence my picture above shows the same.

======================= About the Author =================================

Read about Author at : About Me

Thank you all, for spending your time reading this post. Please share your feedback / comments / critics / agreements or disagreement. Remark for more details about posts, subjects and relevance please read the disclaimer.

Facebook Twitter ContactMe Linkedin ==========================================================================