PaymentIntelligence: Welcome to the Future of Payments. When payments meet artificial intelligence, blockchain, and data science, it produces a culture in the payment industry called Payment Intelligence. Today, most developing and developed economies and countries need specific payment methods and channels as per their environment. One thing that should work as a common goal is how to eliminate corruption, meaning cash. A new technology and payment system with intelligence, i.e., the Payment Intelligence (PI) System, is the answer.

Artificial Intelligence in the Payments Industry

Having more data from digital payment transactions not only helps prevent fraud but also contributes to human health by reducing exposure to bacteria and viruses found on physical currency. Yet, the growing volume poses a challenge for fraud-detection systems. To address this, integrating machine learning into the digital money system boosts its abilities. Trained algorithms and data models excel at spotting anomalies and unusual fraud patterns that might escape human detection.

The current payment system or typical traditional digital payment system has too many limitations and static or rigid variables like merchant type, currency code, country code, location, product type, usual spending range, etc. tied to users. These attributes are almost impossible to change or adjust in an automatic manner, as there is no learning curve. So as the user or customer behaviour changes, the system has no velocity to adjust but just raises or blocks it as potential fraud.

Payments wrapped in AI (machine learning), so-called payment intelligence, improve threat hunting and fraud detection significantly. score-based risk assessment and then adjusting the scores and learning from user behaviour, i.e., spending amounts over a period of time, changes in spending locations, etc. Online transactions with different source IPs and physical distances between transaction originating IPs are a few examples that machine learning can pick and analyse much better and faster. Machines can decide to send OTP in case second-level authentication is needed, and mobile phone cell ID would be an awesome combination there.

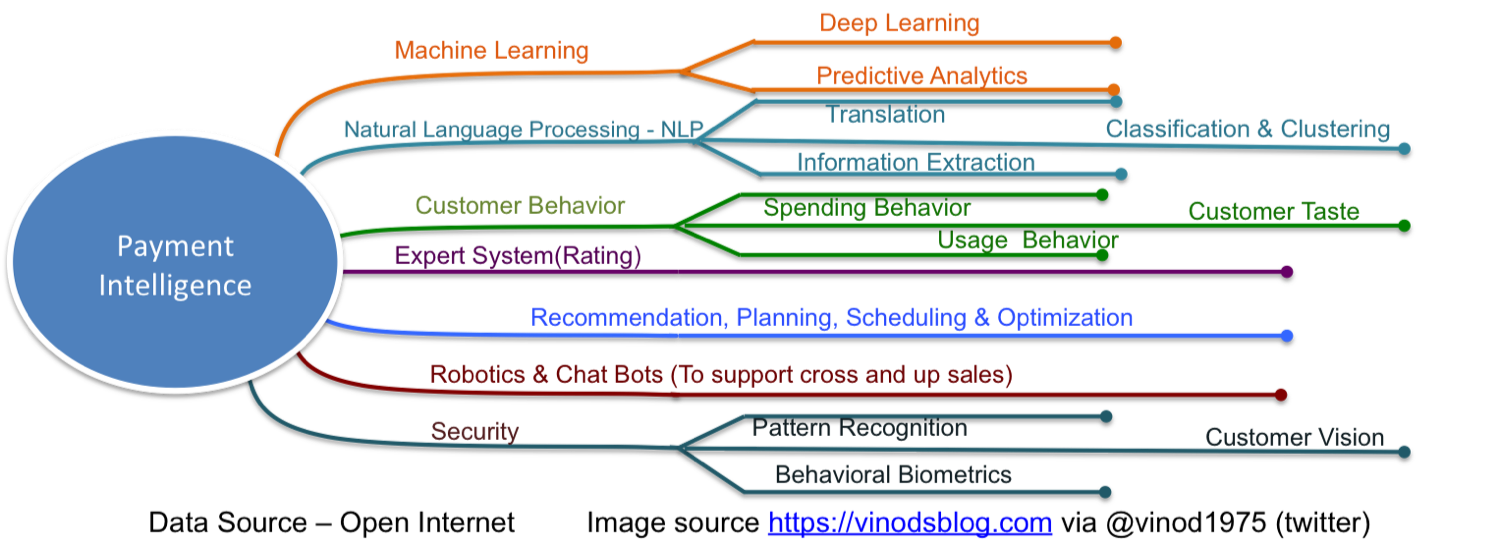

PaymentIntelligence is a new dimension of payment science that combines artificial intelligence, blockchain, data science, and machine learning as its foundation.

This post is an extract from my presentation done at the GECommunity 2017 Summit in Kuala Lumpur, Malaysia. The GE Community Summit is an annual event that attracts the best and brightest talents from academia as well as industry.

Payment Data Inventory – Intelligence Hub

Working with payment data is more complicated than ever. Data fabrication is needed to solve the data intelligence and efficiency gap. Converting idea data that is sitting in silos to a flow of trustworthy data that anyone can use is a very big and complicated task as well. Once it’s done, it can bring lots of value.

AI can push organisations to get faster access to trusted data and make decisions more confidently. The AI-based payments give customers and businesses too many benefits, which are almost impossible to forget. Payment data intelligence brings

- Ensure and trusted data at first sight with Data Inventory

- Dramatically increase efficiency and productivity with Pipeline Designer

- Automate more integration tasks with AI and APIs

Payment intelligence is radically transforming the face of financial services, i.e., from payment systems to clearing to financial settlements. New products like data inventory creators and powerful and capable machine learning algorithms that can accelerate and modernise data engineering

PI Systems Desired Outcomes

To bring people from technical and business backgrounds who can understand and appreciate the need for and concept of artificial intelligence. This is to create products, services, and solutions in the financial technology and banking domains. This new phenomenon of payment intelligence can bring new opportunities to build a strong, thriving, and secured national payment system. The system can raise the bar on delivering the convenience and security of digital currency to people all over the world.

Payment intelligence systems will reduce the risk of cyber fraud, which targets merchants, financial institutions, banks, and customers on the street. The PI fraud management module provides the ability to support early identification of common issues in payments and purchases through intelligence and prevent compromised payments.

Developments in the FinTech space—an industry that received $19 billion in venture capital last year FinTech has grown exponentially on the basis of best practices like rapid response, triage, and preventive analysis of technical forensic investigations. A payment intelligence system comes with the ability to conduct a cyber analysis and develop digital money platform infrastructure.

PaymentIntelligence a New Dimension

PI at the national level can bring the whole nation together. It can secure the economies and flush out the underground economies. In a scenario where you are in a shopping mall and get an SMS, That reads “Walk on to the 3rd floor to buy your favourite brand of clothes to get a 20% discount”.

Because it’s the 25th of the month and you got paid, meaning you have money. So here, merchants, banks, employers, telephony service providers, credit service providers, and many others are all connected to the PI system, so this kind of system can generate business. In the US alone, real-time payment eventually became the first new core payment infrastructure, the most advanced in more than 40 years.

Now a second scenario on top of the first one: “you fall short in your balance system to make payment”. In this system case, the payment intelligence system can offer microcredit of $10 to $500, depending on your credit rating. Even if the system charges you a 10–20% rate of interest for a 3-month period (80% over 12 months), you won’t even mind or make the note.

PaymentIntelligence (PI) System: Can open a lot of opportunities to young entrepreneurs and boost the economy of the nation. Data alone is lifeless and inherently dumb. It doesn’t do anything alone without support, knowledge, and tools on how to use it and how to act on it.

Algorithms are where the real value lies. Algorithms define and drive actions. The whole point of the PI algorithms involved in high-frequency business is to detect, analyse, and make decisions faster than a human heartbeat.

FinTech & AI – Payments with Artificial Intelligence.

FinTech intelligence can help in one way or another how to make money. The application of any computer-enabled algorithm that can be applied against a data set to find a pattern in the data Because of this, new wild and flashy AI systems are making FinTech’s smart systems smarter and can help them to fly. Not surprisingly, these companies each have a clear market application and reduce friction in the business problems they address.

Fintech’s Artificial Intelligence Revolution is a perfect example and era of pervasive AI financial technology services. The aim of payment intelligence is to explore AI potential in the financial sector and to become a major business disruptor. The AILabPage team did a small research project with its freelance members on a global practice that designs and implements digital transformations.

AI Boosting Info-security with Behavioural Biometric

- With account takeover and mobile fraud growing in leaps and bounds. The need has arisen to move beyond password protection and two-factor authentication which anyways has never been greater. Hackers routinely find ways to steal personally identifiable information (PII)

- With BBI Consumers will be able to perform complex transactions. Such as making purchases and payments or transferring funds, without the need to type a single character.

- Behavioral biometrics presents a fairly new approach to monitoring and scoring customer and device interactions during transactions.

- Voice biometrics is been attempted to combine with AI in a bid to directly communicate with chatbots up to the emotional level of understanding. This could probably reduce the need for human operators in call centers in the future while protecting employee perpetrated data leaks

- Companies in the FinTech industry will find multiple opportunities. Such as how to enhance decisions on lending and how to optimize financial advising or execute better trading decisions. AI could also help improve the algorithms to create optimal financial advising.

As digital business remains dynamic and business teams become more engaged in the solution delivery process, We expect this will result in a more complex collection of technologies, disciplines, and practices. This collection is to support the varying needs of users. Organisations must plan for the adoption, or replacement, of key technologies and practices, as well as the development of people and skillsets.

Banking Applications with Artificial Intelligence

Application Artificial intelligence has several applications in the banking industry. Top-5 applications of artificial intelligence in the banking industry that will revolutionise the industry in the next 5 years are listed below.

- Algorithmic trading

- Chatbots

- Customer recommendations

- Fraud detection

- AML Pattern Detection.

The blockchain is here already and while still relatively new to the financial space. It attracted interest from around 90% of banking sector executives though. According to a new study on the potential of technology in the industry. The blockchain is said to be the answer to many information security threats. For business strategies, customer acquisition plans and revenue goals may be in danger due to (Not limited to though)

- Application tampering

- Rogue Apps

- Malware

- Overlay attacks

Artificial intelligence is ready for business but the business may not be ready for AI, this where the major issue is. AI hype putting almost every business in peril and many businesses are now forced to make claims then real work.

Intelligent tools for Threat Intelligence / Threat Hunting.

What is needed in today’s payment market is an intelligent system to do automatic threat intelligence. The system can perform threat hunting without rest in a 24/7 manner. Blockchain will also push PI (payment intelligence) system demand towards the north at rapid speed. Why blockchain when we have AI as a supportive partner in the payment system? The response is actually out of scope for this post, but for now, we can learn it has an important role for payment security reasons. As of date, 40% of the banks find themselves still in the exploration phase of blockchain technologies. While around 30% are pursuing proof of concepts, These are not at all good signs.

intra-bank cross-border transactions are regarded as the most likely payment system to see blockchain implementation, followed by cross-border remittance and corporate payments. PaymentIntelligence brought real-time payment which eventually brought real-time threats as well. P2P and m-commerce payments are fuelling growth in real-time payment systems.

PaymentIntelligence as a Service

One of the technologies which have received considerable hype in recent years is blockchain. A distributed ledger technology (DLT) that serves as the backbone of cryptocurrencies. Application development technologies and disciplines continue to evolve as the need to deliver business outcomes and accelerate application delivery with high quality intensifies. Blockchain’s financial part underpayment intelligence encompasses all types of data science algorithms, supervised, unsupervised, segmentation, classification, and regression including deep learning.

That’s simplistic for a reader to appreciate the importance of Regression. Historical notes on Knowledge discovery and data, CRISP-DM, BIG DATA, and Data Science and their relationship to data mining and Machine Learning are available all over the internet for free. How to put them in real business and discover the hidden potential of such powerful tools to bring values are still not much talked or explored.

Please note I am not advocating AI on blockchain here as the basic architecture for both as per my understanding is a lot different as on date. Also, Deep Learning is different from traditional predictive analytics in my opinion hence my picture above shows the same.

Smart machines producing smart payments with inbuilt payment intelligence. What fascinated me most in PI subject book (Currently being written) the explanation of such complex subject, regression and use of AI and its components. They are described as ‘ a tutor teaching students in an institute – if the outcome is continuous use linear and if it is binary, (Regression) use logistics.

New Job role Payment Intelligence and SECaaS Analysts

Soon in the market or it must have started already in the market in payments and info-security industry to fight cyber-crimes. These professionals will be a great value add to

- Serve as a Global Risk Subject Matter expert on various payment frauds via new brand new platform i.e payment intelligence.

- The new system or PI says will be able to analyse data and respond to alerts relative to SECaaS as the built-in metric.

- Statistics & machine learning techniques surrounding cybercrime case will report and investigated in an automatic manner.

These professionals will lead the design and production deployment of new and advanced techniques to recognise and prevent payment methods and cybercrime.

About the Summit

The summit took place on 12th and 13th December 2017. This was the biggest summit in Malaysia and the opening speech was done by “Sri Haji Mohammad Najib bin Tun Haji Abdul Razak”. Sri Haji is the current Prime Minister of Malaysia since 2009. The event was attended by almost 15,000 participants with speakers from 27 countries around the globe.

If anyone is looking for a complete and detailed presentation free copy, please leave your email address in below comment box. I will talk about different elements of PaymentIntelligence (PI) in this post on a very high level only. The idea is to show what is PI, what it can do and what all elements are in the ecosystem of PaymentIntelligence.

Conclusion – Artificial intelligence is set to transform the financial services industry. How AI will be transforming the future of finTech to elaborate items from the above list in African markets and opportunities are even more dramatic in just the past five years. Africa has payment instruments such as mobile wallets for merchant payments, bill payments, prepaid airtime top-up etc. This infra is ultra modern mobile payment infrastructure with too much packed init.

—

Disclaimer

All credit and credits of contributions remain with original authors and I sincerely thank for their contribution here. Welcome to the future of Payments. In this post, we have discussed the potential merger of AI and its bundle pack i.e. Machine Learning, data science and analytics. In the next post, we will pick up a specific use case to deliberate on.

#PaymentIntelligence #MachineLearning #DataIntelligence #DeepLearning #ArtificialIntelligence

Points to Note:

it’s time to figure out when to use which tech—a tricky decision that can really only be tackled with a combination of experience and the type of problem in hand. So if you think you’ve got the right answer, take a bow and collect your credits! And don’t worry if you don’t get it right.

Feedback & Further Questions

Do you have any burning questions about Big Data, AI & ML, Blockchain, FinTech, Theoretical Physics, Photography or Fujifilm(SLRs or Lenses)? Please feel free to ask your question either by leaving a comment or by sending me an email. I will do my best to quench your curiosity.

Books & Other Material referred

- AILabPage (group of self-taught engineers/learners) members’ hands-on field work is being written here.

- Referred online materiel, live conferences and books (if available)

============================ About the Author =======================

Read about Author at : About Me

Thank you all, for spending your time reading this post. Please share your opinion / comments / critics / agreements or disagreement. Remark for more details about posts, subjects and relevance please read the disclaimer.

FacebookPage ContactMe Twitter ========================================================================

Very insightful and I like the academic approach.

Excellence and exception is clearly seen here pls let me know how much the paid and full version of this ppt is … Send me the email for cost…. I know no free lunch in this world…..

very nice and excellent, this is going to be the future technology.. pls share me your presentation..

very insightful……

Please share the presentation

Very nice and insightful.please share the ppt

email address ??

nice article, could you please share full ppt to me ?thanks

Thanks for kind words, unable to locate your email address

Very insightful, can you share me the ppt to himawanisme@gmail.com? Thanks

Hi Vinod, I would like a copy of the presentation.

email address pls

Thank you for this post.

Please, share the presentation. anamakharadze94@gmail.com

Sent

Very good post regarding AI in business. Please share the ppt.

Thanks for kind words, unable to locate your email address

[…] Blockchain and Digital Payments – PaymentIntelligence […]

[…] All credits if any remains on the original contributor only. You can find our other post on payment intelligence “The new Intelligence in the market – PaymentIntelligence“ […]

Excellent approach Vinod, you have done a great research to achieve this information. Can you share me the presentation to my email? It’s sidney.28.03@gmail.com. Thanks.

sent

Very insightful. Kindly share the presentation on enrohit@gmail.com

Many thanks.

Very useful information. Could you please share your updated powert point?

My email address is: ldejoie@gmail.com

Thanks and regards.

[…] Original post: https://vinodsblog.com/2017/12/13/the-new-intelligence-in-market-paymentintelligence/ […]

[…] This is part 2 of the previous post from 2017 “PaymentIntelligence – Artificial Intelligence in the Payments Industry” […]

[…] Payments-driven models: It revolve around the facilitation of secure and user-friendly payment solutions catering to both individuals and businesses. These models are designed to provide convenient and reliable options for digital payments, mobile wallets, and other electronic transaction systems. […]