BaaS and BaaP – Financial technology is an industry that’s shaking things up, bringing together companies on a mission to make financial services smarter, faster, and, let’s be honest, way cooler. It’s not just about payments and banking anymore—insurance, lending, and wealth management are also getting a major tech facelift.

This wave isn’t just another buzzword fest; it’s a fundamental shift. With AI, blockchain, machine learning, and big data working behind the scenes, FinTech is setting the gold standard for innovation. Startups love it, customers demand it, and even the big guns—Facebook, Apple, Google—can’t resist dipping their toes in.

At the heart of all this? A relentless drive to reimagine finance as an intelligent, adaptive ecosystem. And that’s exactly what’s cooking in my AILabPage Lab—where innovation isn’t just theory, it’s hands-on, tested, and battle-hardened. FinTech isn’t the future; it’s the now, and it’s rewriting the rules as we speak.

BaaS and BaaP are redefining fintech by enabling seamless integration of financial services, but their true power lies in leveraging AI-driven intelligence to deliver contextual, real-time, and adaptive financial solutions.

Fintech Evolution – Outlook

In my 18 years of experience, including 8 years in the FinTech industry, I have witnessed firsthand the extraordinary potential of FinTech. It has demonstrated unprecedented growth horizontally and vertically, reshaping industries and enhancing global financial ecosystems with transformative innovation(TTDCA).

- Trust & Transparency (Blockchain)- In my years in FinTech, I have seen how blockchain technology can ensure secure and verifiable transactions. It fosters trust and transparency throughout the financial ecosystem, enhancing accountability and significantly reducing fraud risks.

- Transformative Intelligence (AI & Machine Learning)- AI and ML have revolutionized the way we process fintech data and make decisions. These technologies automate tasks, generate valuable content, and predict trends with remarkable accuracy, greatly enhancing fintech’s operational and business performance and intelligence.

- Connectivity & Inclusivity (Internet of Thing)- I have witnessed how IoT fosters connectivity and inclusivity by seamlessly integrating diverse financial systems and services. It enables universal access and personalized financial solutions, bridging gaps and creating a more inclusive financial landscape. Check Starbucks use case of IoT to boost their fintech initiate.

- Data Intelligence & Advanced Analytics (Data Science)- Advanced data analytics have been pivotal in providing deep insights that drive informed decisions and strategic planning. Through big data and sophisticated algorithms, Fintechs uncover patterns and optimize processes, empowering strategic growth and innovation.

- Agility & Scalability (Cloud Computing)- Cloud computing offers rapid scalability and flexibility, supporting the dynamic and evolving needs of the FinTech sector. It provides on-demand resources and enhanced operational agility, enabling us to innovate continuously and meet the ever-changing demands of the industry.

I have seen how intelligence becomes the cornerstone of innovation, shaping the future of financial technology. At its core, fintech represents the fusion of technology and finance to enhance the delivery of financial services. While the term gained prominence in the early 21st century, its impact on financial transactions extends back over a century. Initially, fintech innovations included telegraphic money transfers during the late 19th century, albeit far from the sophisticated systems seen today.

Fast forward to the present, and fintech now encompasses cutting-edge technologies like cryptocurrencies and digital banking, capturing the attention of investors worldwide. With a staggering $210 billion invested in fintech businesses in 2021, the landscape is ripe with companies seeking to pioneer the next breakthrough. By examining the significant developmental stages of fintech and predicting its future trajectory, we can uncover the underlying drivers propelling its continued evolution.

FinTech: Transforming Finance Through Innovation

Fintech, short for financial technology, revolutionizes traditional financial services through innovative digital solutions. It encompasses a broad spectrum of technologies and innovations, including mobile banking, peer-to-peer lending, blockchain, and artificial intelligence.

Fintech democratizes finance, making it more accessible, efficient, and affordable for consumers and businesses alike. By leveraging cutting-edge technology, Fintech companies disrupt traditional banking models, offering streamlined processes, personalized services, and enhanced security. Understanding Fintech involves recognizing its transformative potential to reshape the financial landscape, drive economic growth, and promote financial inclusion on a global scale.

In the vast landscape of finance, the emergence of fintech has been akin to a modern-day odyssey. It’s a narrative that spans decades, marked by countless twists and turns, challenges, and triumphs. As someone who has navigated this terrain for years. Fintech’s evolution continues unabated, promising to revolutionize finance further through trends like decentralized finance and sustainable finance, thus shaping a future defined by greater innovation, accessibility, and economic empowerment. I have had the privilege of witnessing firsthand the evolution of fintech from fledgling startups to towering titans.

FinTech in Indian Market

Between 2014 and 2016, and even today, the Indian market has witnessed a surge of companies positioning themselves as FinTech leaders. The rapid proliferation of payment services, wallets, lending platforms, and InsurTech solutions has created a highly competitive landscape. However, many new entrants have struggled to move beyond surface-level implementations, often exiting the market with limited industry knowledge.

For FinTech players with a long-term vision, success lies in leveraging BaaP and BaaS models to deliver specialized services rather than attempting to build and control an entire ecosystem.

The focus is shifting from ownership to collaboration—strategically selecting value-driven services that integrate seamlessly into the financial fabric. Technical companies are entering the financial domain and making it interesting by doing technical integration, or “fintegration”, of FinTech services, the latter interfacing directly with bank customers for banking services including insurance. Finance on internet is becoming Finternet.

FinTech Evolution

Innovation in FinTech is abundant, with ideas frequently being proposed. However, transforming these ideas into sustainable, scalable realities requires deep expertise, regulatory awareness, and a structured execution approach.

| Era | Time Period | Key Developments | Impact on Financial Services |

|---|---|---|---|

| FinTech 0.5 | Pre-1865 | – Ledgers and manual banking – Double-entry bookkeeping (14th century) – Stock exchanges (1602, Amsterdam) – Central banks (Sweden 1668, England 1694) | Laid the foundation for modern financial transactions and banking systems. |

| FinTech 1.0 | 1865–1966 | – 1866: First transatlantic telegraph cable – 1871: Western Union launched wire transfers – 1950s: Diners Club introduced the first credit card – 1958: BankAmericard (Visa) launched | Enabled faster communication and financial transactions, laying the groundwork for global finance. |

| FinTech 2.0 | 1967–2008 | – 1967: Barclays introduced the first ATM – 1973: SWIFT network established for secure international transactions – 1980s–90s: Online banking and electronic trading platforms emerged – 2000s: PayPal, mobile banking, and early FinTech startups gained momentum | Digitization of traditional banking services, increased accessibility, and global payment networks. |

| FinTech 3.0 | 2008–Present | – 2008: Global financial crisis fueled the rise of FinTech startups – 2009: Bitcoin introduced decentralized finance (DeFi) – Mobile payment solutions: MPESA, Alipay, PayPal – AI-driven lending, InsurTech, and Open Banking gained traction | Challenged traditional banks, increasing competition and financial innovation. Growth of alternative finance models. |

| FinTech 3.5 | 2015–Present | – Expansion of Neobanks, challenger banks, and digital-first banking – SuperApps (WeChat Pay, PhonePe) integrate finance into daily life – Growth of BaaS & BaaP models for embedded finance – AI-driven financial intelligence and hyper-personalized services | Focus on financial inclusion, seamless digital experiences, and increased accessibility in emerging markets. |

| FinTech Term Origin | First used in 1971 | – Coined by Citicorp to describe “Financial Technology” – Initially referred to back-end banking innovations – Expanded to include all tech-driven financial services | Term evolved to encompass the digital transformation of the financial sector. |

While the industry continues to evolve at a rapid pace, only those with a clear strategy and execution roadmap will thrive in this new era of financial services.

Who are the leaders of FinTech

Most of the innovations in financial services, including insurance, are coming from leaders who are very new to the industry or come from outside the industry.

- SaaS (Software as a Service), IaaS (Infrastructure as a Service), and PaaS (Platform as a Service) are paving the way for industry-specific models like BaaS (Banking as a Service) and BaaP (Banking as a Platform).

- The strong correlation between income and access to formal financial services is shifting as mobile and internet innovators integrate with mainstream banking.

- Regulatory frameworks are becoming more flexible, with a mix of traditional oversight and self-regulation, allowing FinTech providers to drive financial inclusion and reshape the industry.

Entrepreneurs are leading a pack of disrupters, most of them raised in the shadow of companies like PayPal, who want to change business relationships with money forever.

Banking as a Service

The days are not far away when one can get an independent license or permission to run banking services without being titled or registered as a bank. BaaS providers will provide limited services to ensure customer service at an optimum level, including round-the-clock access from wherever you are in a very safe and secure environment. So in a nutshell, I am claiming divorce of bank and banking (What is needed: Bank or Banking).

Actually, if my calculation and understanding are correct, then the payment bank phenomenon in India is actually a BaaS with the help of a BaaP at the backend. Hundreds of companies came up and want to come up. Few got licenses, but that does not discourage the rest of the companies from pursuing their dreams.

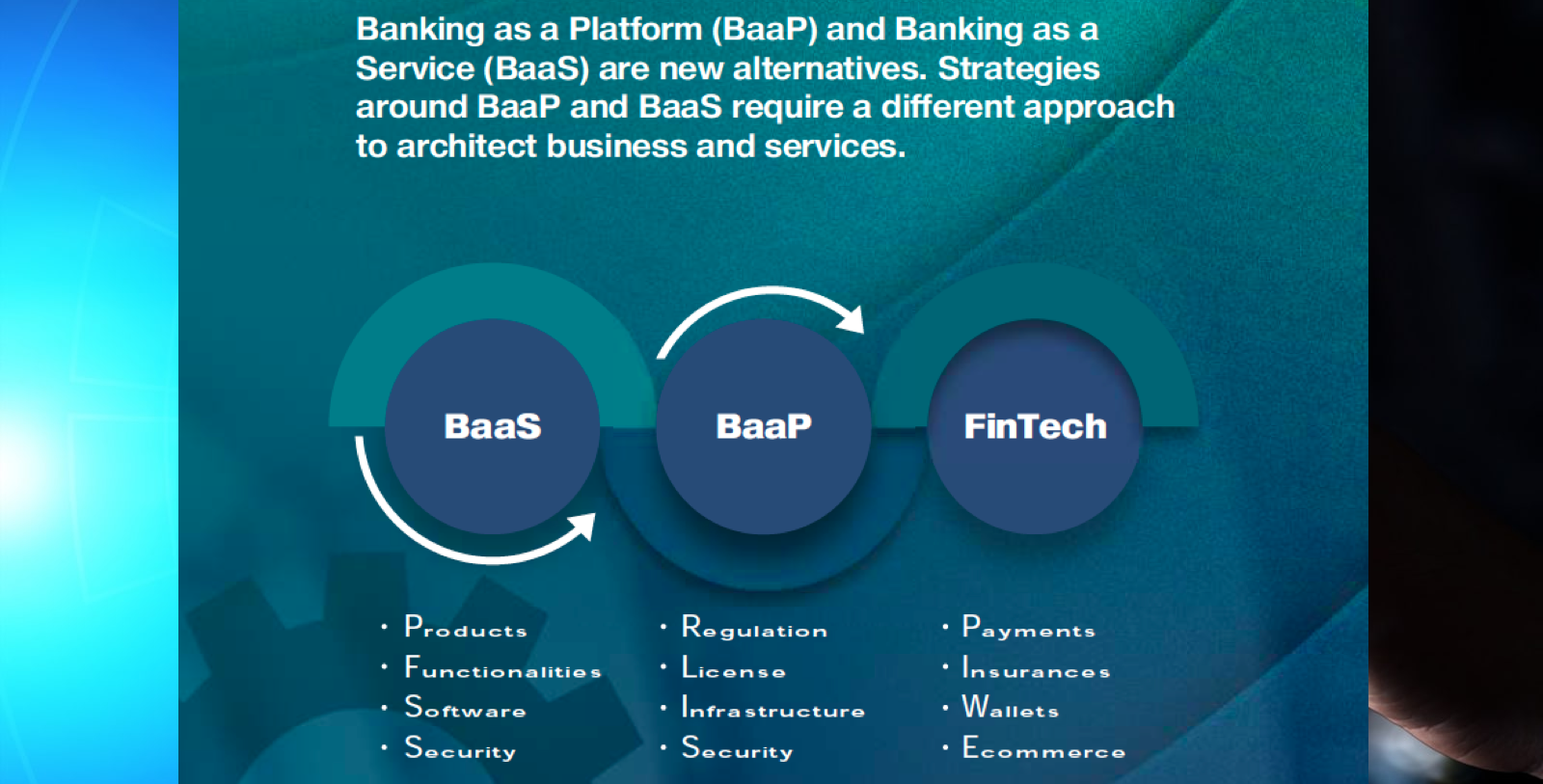

How does FinTech fit into or absorb BaaP and BaaS? Who is who, and what could be the relationship between FinTech and BaaP and BaaS? Well, in my eyes, (I would like to be

corrected) FinTech can sit on top, and BaaS and BaaP become types of FinTech companies, so either a company can be a BaaP FinTech company or a BaaS FinTech company, or depending upon funding and dreams, a single company can be both.

This domain was not opened and was not an interesting space to be in for a very long time. If I recall, the view was that there were such strong monopolies there in terms of the existing banks and insurance companies that no one built a successful payment or insurance company with the exception of 1 or 2 names that were too limited to very few advanced and developed markets. Micro-Payments and micro-insurance market sizes are almost as equal to the macro market in terms of value, but yes, volume is almost 2 to 3 folds higher

Banking as a Service- BaaS FinTech

Banking services and insurance, as part of the FinTech revolution, have been evolving since the early 2000s. Their transformation gained unstoppable momentum with the rise of mobile money and digital payments.

Mobile Network Operators (MNOs) were the first to seize this opportunity, disrupting traditional banking by offering financial services where banks either hesitated or simply weren’t interested.

- BaaS as a Market Disruptor – Banking as a Service (BaaS) surged in markets with low banking penetration, bridging critical financial gaps where traditional banks hesitated to enter.

- API-Driven Financial Ecosystems – The future of financial services lies in modular, scalable platforms powered by APIs, enabling new products, partnerships, and revenue streams beyond traditional banking structures.

- Decoupling Banking from Banks – The long-standing marriage between banks and banking is over—disruptors like MNOs and FinTechs have reshaped the landscape, proving financial services can thrive beyond traditional institutions.

Banking was a slow-moving giant, tied to physical branches, endless paperwork, and rigid operating hours. Then came the MNOs and Mobile Financial Service Providers—the disruptors. They saw the inefficiencies, inserted themselves right in between, and rewrote the rules of engagement. The result? Banking and banks were no longer synonymous. Whether you call it a forced divorce or a strategic realignment, one thing is clear: the power dynamics in financial services have changed forever.

Banking as a Platform – BaaP FinTech

Banking as a Platform (BaaP) isn’t a new concept, but looking at it through today’s lens, it sure feels like one. The rise of BaaP goes hand in hand with Banking as a Service (BaaS)—both were born when non-banking companies decided they wouldn’t wait for traditional banks to catch up. They took matters into their own hands, reshaping financial services with API-driven, cloud-first, and user-friendly solutions that are leagues ahead of legacy banking systems.

FinTech: The Engine Powering Modern Payments

FinTech has taken the driver’s seat in global financial services, knowing full well that modern payment solutions must be agile, scalable, and secure—constantly evolving to match shifting consumer behavior. With BaaP-FinTech infrastructure, merchants can accept payments faster, expand financial inclusion, and scale their businesses without the traditional banking baggage. I wrote about this shift back on June 16, 2015, in my article “Cloud-based Mobile Financial Services and Payments.” It was clear then, and even clearer now—banking is no longer a place you go, but something that integrates seamlessly into daily life.

The Big Bet on BaaP: FinTechs, Banks & the Gravy Train

The BaaP roadmap isn’t just theory anymore—real money is flowing in. Companies like (Solaris Bank Germany) in Germany have already placed their bets, investing in the regulatory and technological infrastructure needed to make BaaP a reality. A fully digital, licensed bank partnering with a FinTech startup to offer banking as a platform? Now that’s a game-changer. It’s a win-win: FinTech startups get to ride the fintech gravy train, while businesses gain easy access to banking services without the usual friction.

The Future is Modular, Intelligent & Borderless

FinTech leaders are serving up banking services that are intuitive, flexible, and designed for businesses—not just financial institutions. The new financial ecosystem includes:

– Accounts & transaction services – frictionless banking at your fingertips

– Insurance & compliance solutions – trust built-in, not bolted on

– Working capital financing – because businesses shouldn’t have to beg for liquidity

–Online loans & embedded finance – funding meets convenience, minus the red tape

Bottom line? BaaP isn’t just an alternative; it’s the future of finance—a future where banking is a plug-and-play service, not a monolithic institution. And as always, FinTech is leading the charge.

Analysing – BaaP and BaaS

BaaP-FinTech will actually support all small-scale FinTech companies to come together. With the help of BaaS on BaaP, new innovative services to consumers will bring lots of value, and new products will be available in a kind of pool where hosting will make it easier to use any service by any consumer of any service provider. Adding the flavor of Finclusion on top of BaaS will really help exit services reach segments that are excluded.

In the IT domain, we have three “aas” services broadly classified as Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS), and all of them are quite useful for the FinTech domain, but time is here to extract the best out of all “?aas” services to bring BaaP and BaaS. Both Baas and BaaP will be a driven version, specialized and designed for financial services, including insurance for payments, Finclusion (financial inclusion), and insurance. Defining any of IaaS, PaaS, or SaaS or talking about their advantages and disadvantages is out of scope here as the focus is on BaaP and BaaS.

Challenges and Complexities of BaaP-FinTech

BaaP-FinTech is not an easy route or option, as to me it’s still a dream, and to many others, BaaP is already facing difficulties to come to life and protests from service providers as well as platform providers.

| Aspect | Service Provider Perspective | Platform Provider Perspective | Impact on FinTech Ecosystem |

|---|---|---|---|

| Mindset | “I am the biggest, I am the boss, I own the customer.” | Sees value in enabling multiple service providers through platforms. | Shifts power dynamics, making financial services more accessible. |

| Approach | Protects market share, avoids sharing data or infrastructure. | Sells platforms to multiple service providers, creating scalability. | Encourages collaboration, driving financial inclusion and innovation. |

| Revenue Model | Focuses on direct customer ownership for revenue. | Develops functionality once and monetizes it across multiple buyers. | Leads to lower costs and higher efficiency for financial services. |

| Innovation | Limited to in-house capabilities and priorities. | Facilitates cross-industry innovation by sharing ideas and features. | Accelerates fintech growth with new business models and solutions. |

| Market Reach | Works within a closed ecosystem, limiting external collaboration. | Expands reach by selling to many service providers across industries. | Opens up markets for SMEs and startups to compete with incumbents. |

| Challenges for BaaP | Faces resistance as the traditional service model is more familiar. | Disrupts traditional models but unlocks significant financial gains. | Adoption hurdles but long-term potential for scalable growth. |

| Impact on African Market | Banks and insurers risk losing dominance to agile fintech disruptors. | Offers opportunities for new entrants and innovative solutions. | Strengthens financial ecosystems, benefiting end consumers. |

The reality and status of the current availability of services from banks are far behind the capabilities of modern infrastructure and new e-commerce innovations. The financial sector is already facing significant competition in the electronic and online spaces. Today, people still keep their money in the banks because it’s the institution created for money (for ages). Basically, what money and the economy mean for people, as we know, is trust.

BaaS and BaaP: Paving the Way for Digital Banking Revolution

However, it was the wallet in the pocket that became the prime target, creating complications in integrating various funding sources such as bank accounts, mobile wallets, and plastic cards. Amidst this, BaaS and BaaP emerge as pivotal players with the potential for resounding success. Banks and insurers, traditionally central to customer engagement, are set to transition into a future where a fully licensed digital bank, empowered by BaaS and BaaP, will drive an expansive spectrum of FinTech services.

Moreover, all reports and real facts on the ground have shown that cross-border remittances contribute to high economic growth. AILabPage’s research indicates that it can have a greater impact than ODA and FDI as well. This might suggest that remittances serve as a social safety net for those who are not the poorest but who would be in need of targeted social assistance without remittances.

Do we really need this new BaaP or BaaS; I think it’s very easy to answer or has the answer already “Yes”. How long has it been staying the same?.

Conclusion: The financial services industry, including the insurance industry, is facing a long-pending wave of digital disruption. This disruption has started to reshape the entire banking and payments sector. Payment as a Service (PYaaS)-type services are really needed in the industry. By looking at current issues like high cost, slow speed, and bundles of papers for KYC, this new concept of BaaS will revolutionize the market. We have too many payment companies in the market with zero or no experience but still doing well on a gratitude basis, as talent and education may not be needed here. Banks have platforms, but it’s probably fair to say it’s more like yesterday’s platform or the stone age.

—

Points to Note:

In the evolution of Banking-as-a-Service (BaaS) and Banking-as-a-Platform (BaaP), the challenge extends beyond simply embedding financial services. The real differentiator lies in leveraging AI-driven financial intelligence to determine when and how to apply adaptive finance models. Whether it’s risk assessment, dynamic credit scoring, or hyper-personalized financial offerings, the key decision isn’t just about technology—it’s about experience, context, and solving the right problem at the right time.

Books + Other readings Referred

- Research through Open Internet – NewsPortals, Economic development report papers and conferences.

- Personal experience of @AILabPage members.

Feedback & Further Questions

Besides life lessons, I do write-ups on technology, which is my profession. Do you have any burning questions about big data, AI and ML, blockchain, and FinTech, or any questions about the basics of theoretical physics, which is my passion, or about photography or Fujifilm (SLRs or lenses)? which is my avocation. Please feel free to ask your question either by leaving a comment or by sending me an email. I will do my best to quench your curiosity.

====================== About the Author =================================

Read about Author at : About Me

Thank you all, for spending your time reading this post. Please share your feedback / comments / critics / agreements or disagreement. Remark for more details about posts, subjects and relevance please read the disclaimer.

FacebookPage Twitter ContactMe LinkedinPage ==========================================================================

Excellent resource thank you for sharing

[…] Little History on Financial Technology – FinTech […]

[…] https://vinodsblog.com/2016/03/25/fintech-the-baap-baas-boomer/ […]

[…] 2024, the FinTech sector faces challenges like reduced funding and increased regulatory scrutiny on Banking as a Service (BaaS) providers i.e. […]