Recommenders – Conclusion extraction and giving recommendations to customers is now very common and regular practice in the e-commerce domain. FinTech owned e-commerce businesses are leading this industry forward even while we are asleep. Recommendation engines based on machine learning and AI capabilities help for better data analytics and predictions. How to recommend, how much to spend and what augmented experience give a succinct response are a few examples here. With artificial intelligence combined with other data intelligence, this industry is exploding already.

This blog post is from my visit as a Keynote speaker in GCC Blockchain event in Dubai on 22 and 23 November 2017. I advocated for my area on AI and its subfield for FinTech.

GCC Blockchain Event

The event was well organised and was full of insights on how Blockchain can equally disrupt & make stronger complimentary relationships with FinTech, unlike artificial intelligence. The event was on the lines of Dubai government goals towards making Dubai the first Blockchain-powered economy in the world by 2020.

How various services areas in public and private organizations can benefit from blockchain technologies?

The event was helpful to get answers and explore the possibilities on what potential does Blockchain and distributed ledger technology (#DLT) have. How these transparent, trustworthy and efficient ledgers will disrupt FinTech more. The whole idea was to revolutionize various or almost every business sector.

Recommender Engines and FinTech

How to recommend how much to spend, on what to spend, how to give the best augmented and concise experience to customers. Shopping, of course, is not the only industry to leverage recent advances in machine learning. The list of companies and industries is growing by the day in addition to the various applications of machine learning. Common applications of machine learning in today’s technology include voice recognition, fraud detection, email spam filtering, text processing, search recommendations, video analysis, etc.

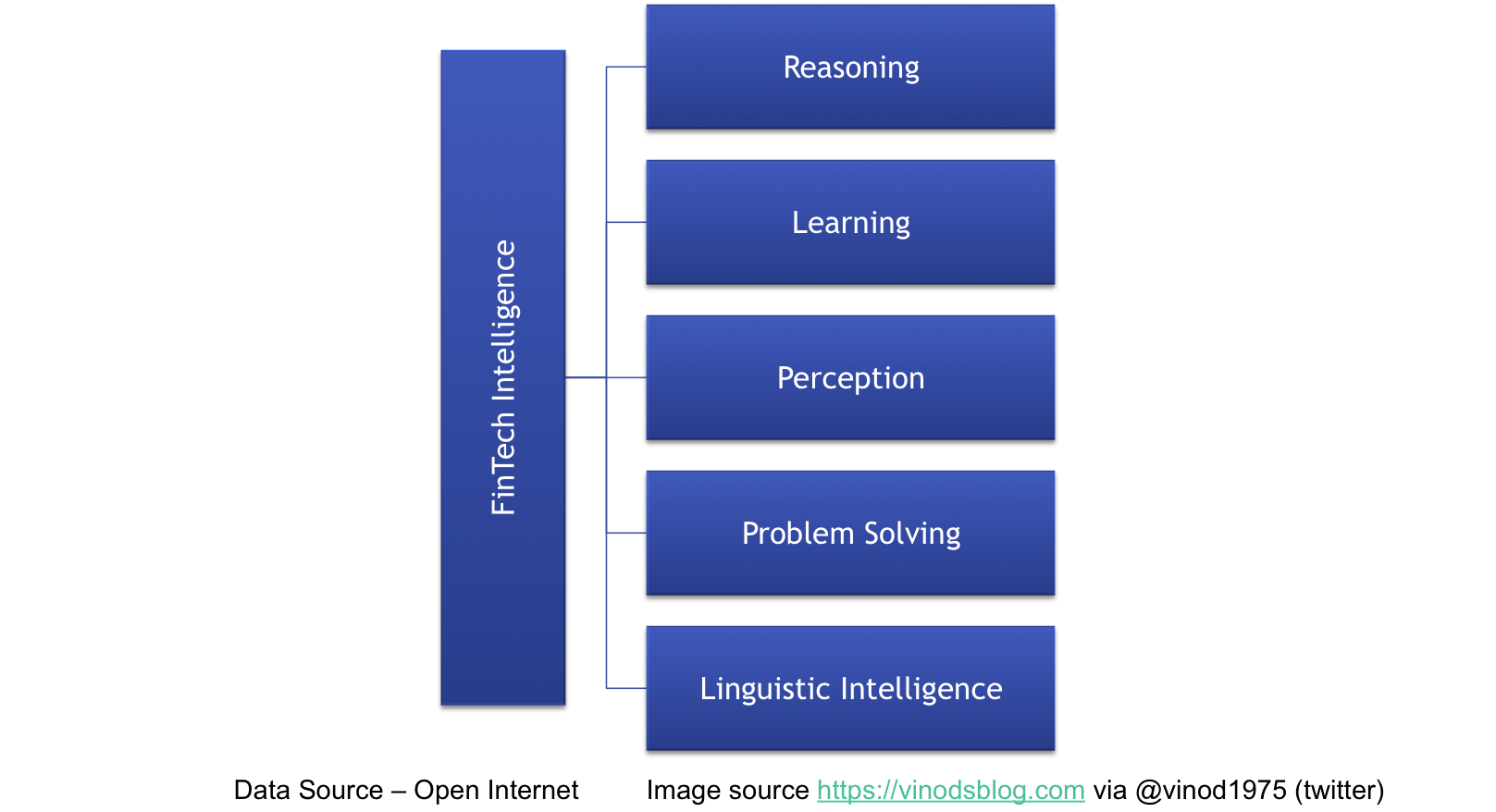

How FinTech Intelligence (AI+FinTech = FI) will become better with machine learning. Artificial Intelligence is a field that includes everything that is associated with the data (cleansing, preparation, analysis and many more), Learning processes to describe, diagnose, predict and prescribe with use of AI subfields like Machine Learning, Deep earning and Neural networks. Machine learning allows software applications for making near accurate results based upon quality data. Some of the roles machine learning is playing in the FinTech domain (Not limited to though)

- Bringing behavioural biometrics to boost security in FinTech

- Deductive, Reasoning, Problem Solving with ML for FinTech

- Help and ease for bill payments/collections in an automated way

- Big data helps to make a strategy for the future and understand user behaviours.

- Secure Electronic Transaction enables interoperability between applications across diverse platforms and operating systems.

To illustrate the various applications of AI in eCommerce and use case studies to show how this technology has benefited merchants/e-commerce service providers. Different consumers have varied, and often very specific, requirements for the product, needs, expect performance, cost of consumption, silicon wafer thin kind of cost for the best thing in mind and other parameters. In addition, these current technologies are being improved daily, with these improvements being fueled by greater data analytics, reduction in the cost of computation, and advancements in the state of the art of machine learning research.

Chatbots, AI and Blockchain in FinTech

The chatbot is not a robot or robotics. The bot is just a simple service. Consumers use these services (unknowingly more) to interact with banks, IT companies etc. customer care informs of verbal conversation and messaging. The chatbot is not necessary an AI or Machine Learning software. Surely AI, ML and DL can make bot better. Client-server to the web to mobile apps and now bots are coming in our way. Data visualization & virtualization is about keeping data at the top of the priority list. Business success should be the AI goal.

Computer programmes alter “thinking” or output once exposed to new data for the same information. In order for machine learning to take place, algorithms are needed. Algorithms are put into the computer and give it rules to follow when dissecting data. In FinTech domain apps with AI at the top layer are coming out almost every day. The company developing a financial app.

Some of these apps go a step beyond the automatic investing functions (Investment apps) of robot-advisors, which absorb huge amounts of financial analysis to buy and sell securities automatically etc. These kinds of apps have the ability to takes the spare change from any buy you make – if you allow it – and invests it automatically.

We hear the term “machine learning” a lot these days (usually in the context of predictive analysis and artificial intelligence), but machine learning has actually been a field of its own for several decades. Only recently have we been able to really take advantage of machine learning on a broad scale thanks to modern advancements in computing power. But how does machine learning actually work? The answer is simple: algorithms. For example, a decision tree can be used in credit card fraud detection. These terms are used to form BI Intelligence.

AI as a Partner to FinTech

AI should be treated as a partner and friend in defining FinTech goals and opportunities. Data Science understands the signifies data for better business. As the usage of Big Data for small credit business is incredible.

We would find the attribute that best predicts the risk of fraud is the purchase amount (such as that someone with the credit card has made a very large purchase). This could be the first split (or branching off) – those cards that have unusually high purchases and those that do not. Then we use the second best attribute (such as, that the credit card is often used) to create the next split. We can then continue until we have enough attributes to satisfy our needs.

We would find the attribute that best predicts the risk of fraud is the purchase amount (such as that someone with the credit card has made a very large purchase). This could be the first split (or branching off) – those cards that have unusually high purchases and those that do not. Then we use the second best attribute (such as, that the credit card is often used) to create the next split. We can then continue until we have enough attributes to satisfy our needs.

Machine learning algorithms can be used for other purposes, we are going to focus on prediction in this guide. “Machine learning is used in a lot of technology we use today. Machine learning helps us get from place to place, gives us suggestions, translates stuff, even understands what you say to it. How does it work? With traditional programming, people hand code the solution to a problem, step by step. SME in this area is not only able to uncover patterns in the things they study but to use this information to predict the future with accuracy as well.

With machine learning, computers learn the solution by finding patterns in data, so it’s easy to think there’s no human bias in that.” “Just because something is based on data doesn’t automatically make it neutral. Even with good intentions, it’s impossible to separate ourselves from our own human biases, so our human biases become part of the technology we create in many ways.” A financial analyst may try to predict the ups and downs of a stock based on things like market capitalization or cash flow.

Points to Note:

All credits if any remains on the original contributor only. We have covered all basics around data models or the importance of quality data and training data. In the next upcoming post will talk about implementation, usage and practice experience for markets.

Books + Other readings Referred

- Research through open internet, news portals, white papers and imparted knowledge via live conferences & lectures.

- Lab and hands-on experience of @AILabPage (Self-taught learners group) members.

Feedback & Further Question

Do you have any questions about AI, Machine Learning, FinTech, Data Science or Big Data Analytics? Leave a question in a comment section or ask via email. Will try best to answer it.

Conclusion – Artificial intelligence is set to transform the financial services industry. How AI will be transforming the future of FinTech to elaborate items from the above list in African markets and opportunities are even more dramatic – In just the past five years. Modern mobile payment infrastructure availability – Africa has payment instruments such as mobile wallets for merchant payments, bill payments, prepaid airtime top-up etc. Smart machines producing smart payments with inbuilt payment intelligence. How to recommend, how much to spend and what Augmented experience give a succinct response to this with artificial intelligence combined with other data intelligence.

Conclusion – Artificial intelligence is set to transform the financial services industry. How AI will be transforming the future of FinTech to elaborate items from the above list in African markets and opportunities are even more dramatic – In just the past five years. Modern mobile payment infrastructure availability – Africa has payment instruments such as mobile wallets for merchant payments, bill payments, prepaid airtime top-up etc. Smart machines producing smart payments with inbuilt payment intelligence. How to recommend, how much to spend and what Augmented experience give a succinct response to this with artificial intelligence combined with other data intelligence.

====================== About the Author ================================= Read about Author at : About Me Thank you all, for spending your time reading this post. Please share your feedback / comments / critics / agreements or disagreement. Remark for more details about posts, subjects and relevance please read the disclaimer.

FacebookPage Twitter ContactMe LinkedinPage ==========================================================================

AI will ensure ecommerce grow and stay alive as NI has reached its limit

[…] This article originally appeared in vinodsblog.com. To read the full article, click here. […]

[…] ML has Organizations have had success with each type of learning, but making the right choice for your business problem requires an understanding of which conditions are best suited for each approach. Types of machine learning algorithms i.e. MLAlgos and which one to be used when is extremely important to know. The goal of the task and all the things that are being done in the field and put you in a better position to break down a real problem and design a machine learning system. […]

[…] The goal of the task and all the things that are being done in the field and put you in a better place to break down a real problem and design a machine learning system. […]

[…] The goal of any machine learning task and all the things that are being done in the field that puts you in a better position is to break down a real problem in design form for machine learning systems. […]

[…] The goal of the task and all the things that are being done in the field and put you in a better place to break down a real problem and design a machine learning system. […]

[…] Each type of machine learning provides a strategic and competitive advantage but the availability of quality data basis which technique is chosen is far more important. Types of machine learning algorithms and which one to be used when is extremely important to know. The goal of any machine learning task and all the things that are being done in the field that puts you in a better position is to break down a real problem in design form for machine learning systems. […]