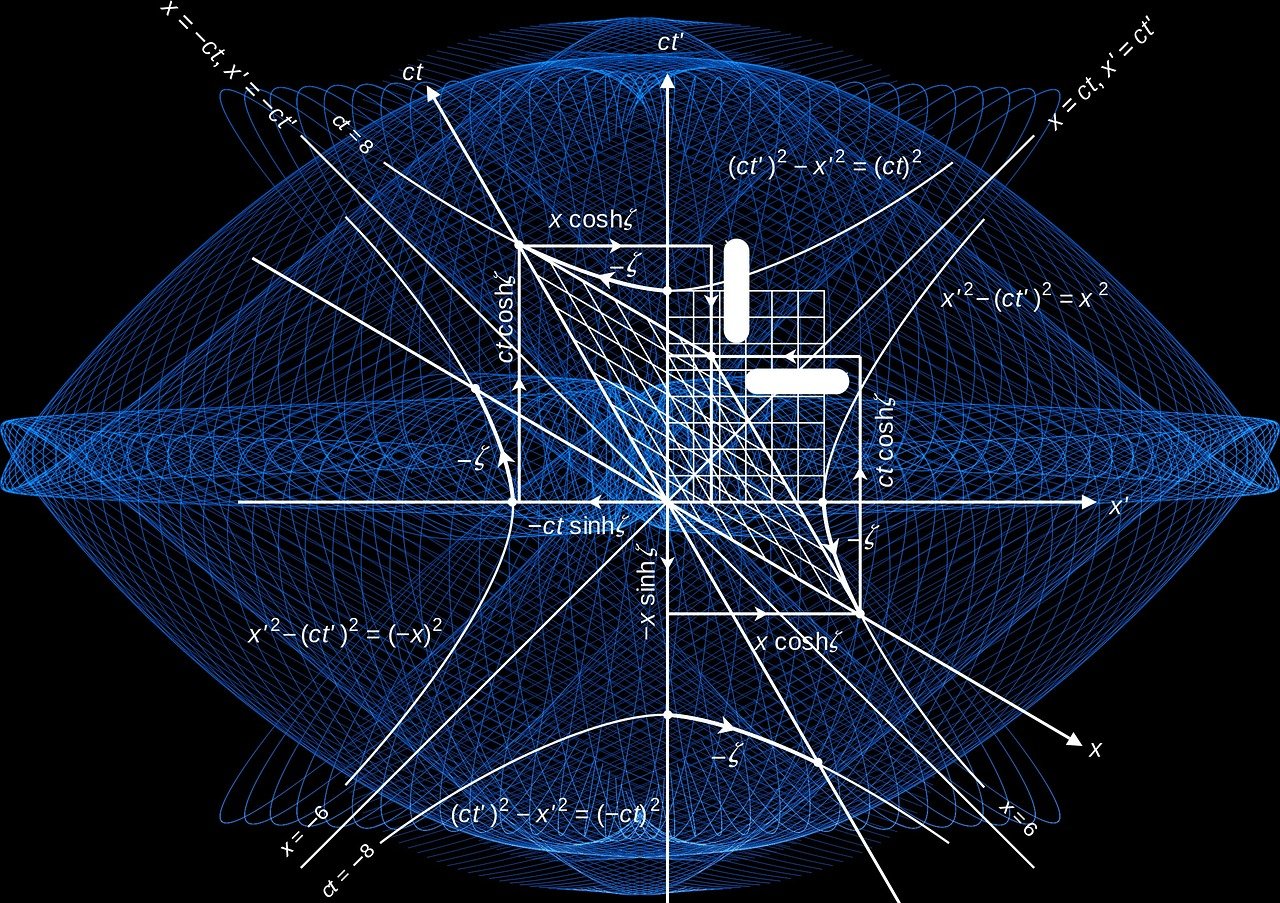

Theoretical Physics – Powerful, Dangerous and Useful

Theoretical physics uses higher mathematical models and conceptual frameworks based on physical phenomena to gain insight into and anticipate the workings of our world. The intricate elements of the cosmos…

Data Science of Payments

How come my bank knows what I am going to buy next, how come my internet browser offering me add on something which I was searching on google few minutes…

Machine Learning in Fintech- Demystified

The financial services industry has already implemented machine learning. Numerous fields utilize it, including intricate solutions such as thwarting fraudulent activities, assessing risks, obtaining a deeper knowledge of customers, and…

ISO-12812 Made MFS Easy for FinTech

The promotion and assurance of consumers' protection are being prioritised through the ISO-12812 standards for mobile financial services, including mobile money, payments, banking, etc. ISO 12812 primarily targets industries in…

Blockchain and Artificial Intelligence

Computers start simulating the brain's sensation, action, interaction, perception and cognition abilities. Blockchain is a new approach to manage/monitor financial and other transactions, Guarding an innovation department or powerhouse lab…

AI and Big Data for FinTech & InsureTech

The analysis of big data can provide valuable insights, trends, and patterns that can help organizations make better business decisions, improve operations, and develop targeted strategies. To effectively process and…

Big Data for FinTech and InsureTech

Automating policy administration, & claims pay out to bring big smile on customer face, improving distribution via marketplaces. The wide variety of data volumes generated by FinTech, InsureTech and MedTech…

International Remittances Outlook

Migration and remittances represent numbers and facts behind the stories of international migration and remittances. Remittances have an impact across the globe, but growth in Africa has lagged behind other…

Magic Word Pay in Digital Payments

Today’s consumer expects a seamless mobile payment experience; failing to meet those expectations can be devastating to a brand, idea, innovation and eventually the payments industry. The world's best companies;…

Artificial Intelligence for Digital Payments Security

The best to protect data from stealing by hackers; may be by not converting and putting the data in system, In the old days people says keep smiling it does…

Privacy, Innovations and Security in Digital Payments

Against escalating security threats on mobile payments, empowerment of merchants, acquirers, and service providers with new commerce opportunities and experiences in store and protection should

Payments – Innovation & Info-security

infrastructure of the payment solution without having to worry about the currency or country I am in, the amount in my payment instrument, the service provider, the recipient, the time…

Remittances – Game Changer For Economic Development

If just for a minute we can assume every person on this planet has mobile phone, every mobile user has a bank account/wallet, every bank account is created instantly, virally…

Digital Payments – Security vs Speed

Abstract – In Digital payments world million dollar question comes in at every stage what is more important security or speed (Performance & Ease). Financial system security design principles can…

Fujifilm X-T2: The Perfect Travel Companion With Portability and Power

The Fujifilm X-T2 is a favorite among enthusiasts and professional photographers alike, thanks to its impressive image quality, versatile features, and stylish design. It is well-suited for a wide range…

Transformation of Payments

Digital transformation can detect potentially fraudulent operations and minimize risks. It can also help large organizations such as banks not only to secure their business but also fight crimes. How…